No More Mistakes with Flour Mill Machine Manufacturer

Mar 11 2023

Manufacturing facilities across North America harbor billions in unused or underutilized equipment annually. This represents a staggering opportunity cost, with capital gathering dust on factory floors and storage facilities. For many operations managers, the predicament is familiar: valuable machinery sits idle while budget constraints limit new initiatives. What if unused machinery could fund innovation? Many organizations fail to recognize that assets depreciating in warehouses could be transformed into working capital through strategic disposition when they plan to sell electrical equipment.

Manufacturing efficiency demands continuous improvement, but many decision-makers overlook the potential of asset recovery programs. Capital liberation through surplus monetization offers a compelling alternative to other funding mechanisms when economic pressures mount. The challenges are legitimate: determining fair market value, identifying appropriate channels, managing logistics, and navigating tax implications present significant obstacles. But with the right approach, these obstacles become gateways, turning surplus into strategy and idle stock into immediate impact.

The foundation of successful equipment monetization begins with accurate valuation. Determining fair market value requires methodical assessment rather than guesswork. Companies consistently achieve higher returns when utilizing structured valuation protocols instead of subjective estimates.

Valuation factors include age, condition, operational status, market demand, technological relevance, and replacement costs. Professional appraisers typically employ three primary methodologies:

Cost approach: Calculating replacement cost minus depreciation

Market approach: Analyzing comparable recent sales transactions

Income approach: Projecting potential earnings from continued operation

Organizations should conduct thorough equipment audits using digital audit tools that systematically document equipment specifications, condition assessments, and maintenance histories. These platforms generate standardized reports that substantiate asking prices and accelerate sales processes.

Compile original purchase documentation and costs

Gather maintenance records and upgrade histories

Document current operational status with testing results

Photograph equipment from multiple angles

List all accessories, manuals, and supplementary materials

Note manufacturer, model, serial numbers, and production dates

For organizations lacking valuation expertise, third-party appraisal services offer objective assessments that strengthen negotiating positions. The investment in professional valuation typically returns threefold through optimized pricing strategies and expedited sales processes.

Selecting appropriate sales channels dramatically impacts both recovery rates and liquidation timelines. Organizations must evaluate channel options based on urgency, volume, equipment type, and internal resource availability.

Parameter | Direct Sales | Auctions | Buyback Programs |

Average Recovery Rate | 65-80% of FMV | 50-70% of FMV | 40-55% of FMV |

Liquidation Timeline | 3-6 months | 1-2 months | 1-4 weeks |

Resource Requirements | High | Medium | Low |

Market Reach | Limited | Extensive | Guaranteed |

Administrative Burden | Significant | Moderate | Minimal |

Direct sales channels require substantial internal resources but deliver superior returns for high-value, specialized equipment. Organizations managing direct sales should establish dedicated landing pages, develop targeted email campaigns, and leverage industry networks. This approach proves most effective for equipment with limited depreciation and ongoing manufacturer support.

Buyback programs provide guaranteed liquidation but at lower recovery rates. These programs excel when speed and convenience outweigh maximum value recovery, particularly for standard equipment with established secondhand markets. Organizations should negotiate volume-based incentives when liquidating multiple units through buyback channels.

When conventional sales channels yield insufficient returns, creative repurposing and systematic recycling offer alternative value recovery pathways. These approaches transform seemingly obsolete equipment into valuable resources while supporting sustainability initiatives.

Tier 1: Control systems, motors, and precision components (60-80% recovery)

Tier 2: Structural elements and power transmission components (30-50% recovery)

Tier 3: Consumable parts and fasteners (10-25% recovery)

Refurbishment programs offer another compelling alternative, particularly for industrial machinery with modular designs. These programs replace worn components, upgrade control systems, and recertify operational capabilities.

For equipment beyond economic repair, materials recovery provides final-stage value extraction. Modern recycling processes recover:

85-95% of ferrous metals

70-90% of non-ferrous metals

50-65% of precious metals from electronic components

30-45% of composite materials

Organizations should develop systematic disassembly protocols that segregate materials by type and purity to maximize recycling premiums. Additionally, specialized recyclers offer certification programs documenting responsible disposal, which organizations can leverage within sustainability reporting.

The repurposing decision framework should evaluate multiple factors, including original equipment cost, current market conditions, refurbishment expenses, component value, and recycling returns. This comprehensive analysis often reveals value recovery opportunities invisible to traditional liquidation approaches.

Strategic management of surplus equipment disposal delivers substantial tax advantages while ensuring regulatory compliance.

Capital loss harvesting: Timing disposals to offset gains in other business segments

Charitable donations: Deducting fair market value while supporting educational institutions

Trade-in programs: Leveraging depreciation benefits while reducing new acquisition costs

Environmental credits: Capturing incentives for sustainable disposal practices

Documented valuation becomes critically important for tax purposes. Independent appraisals meeting IRS requirements provide the substantiation necessary for maximizing deduction values while minimizing audit risks.

Independent written appraisal from a qualified specialist

Completed IRS Form 8283 for non-cash charitable contributions

Written acknowledgment from the recipient organization

Detailed equipment specifications and condition assessment

Photographs documenting equipment condition

Transfer of ownership documentation

Beyond tax considerations, organizations must address regulatory compliance regarding environmentally sensitive materials. Equipment containing hazardous substances requires specialized disposal protocols, with non-compliance penalties potentially exceeding the equipment's entire value. Companies should maintain comprehensive disposal documentation demonstrating proper handling of:

Oils and lubricants

Electronic components containing heavy metals

Materials containing regulated substances

Batteries and power storage devices

Effective marketing transforms surplus equipment from anonymous inventory into compelling opportunities. Organizations implementing structured marketing programs reduce liquidation timelines while increasing recovery rates.

Audience identification: Targeting buyers with specific application requirements

Value proposition development: Articulating competitive advantages and cost savings

Multi-channel promotion: Distributing listings across specialized platforms

Response management: Providing prompt, detailed answers to inquiries

Negotiation support: Offering flexible terms while maintaining value thresholds

Digital visibility through search engine optimization delivers exceptional returns for surplus equipment marketing. Organizations should develop detailed equipment profiles incorporating industry-specific terminology, technical specifications, and performance capabilities. Research indicates that listings with comprehensive specifications receive more inquiries than abbreviated descriptions.

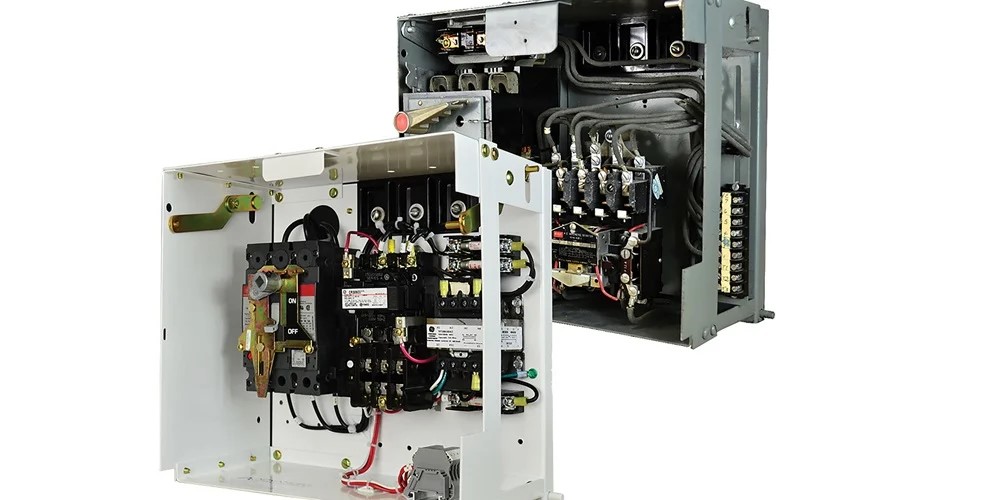

Multiple high-resolution photographs from various angles

Detailed specifications with dimensional drawings

Operational videos demonstrating functionality

Maintenance history and recent inspection results

Available accessories and supplementary materials

Shipping dimensions, weights, and de-installation requirements

Beyond digital channels, organizations should leverage industry networks, trade publications, and specialized forums to reach qualified buyers. Relationship-based marketing through industry associations yields quality leads, particularly for specialized equipment with limited market appeal.

Timing considerations significantly impact marketing effectiveness. Industry analysis indicates optimal liquidation windows align with capital budget cycles, typically showing greater engagement during Q4 and Q1 compared to mid-year periods. Organizations should time major liquidation initiatives accordingly while maintaining continuous programs for opportunistic buyers.

That surplus gear collecting dust in your facility? It could be worth more than you think. Effective surplus equipment monetization doesn’t just free up space, but it turns dormant assets into active cash flow. If you're holding onto surplus electrical equipment, now’s the time to act. Start with a free gear valuation from United Industries and see how much capital is hiding in your inventory.

How long does equipment liquidation typically take?

Liquidation timelines vary significantly based on equipment type, condition, market demand, and selected sales channels. High-demand standardized equipment often sells within 30-45 days through specialized platforms, while custom or niche equipment may require 6-9 months through direct sales approaches.

What documentation is needed for tax-deductible donations?

Tax-deductible donations require independent written appraisals for items exceeding $5,000 in value, completed IRS Form 8283, written acknowledgment from the recipient organization, and comprehensive equipment documentation. Organizations should consult tax professionals to ensure compliance with current requirements.

How can organizations determine if refurbishment is economically viable?

Refurbishment viability analysis should compare renovation costs against both new replacement pricing and current market values for comparable used equipment. Generally, refurbishment proves economical when costs remain below 40% of new equipment pricing while the refurbished unit commands at least 60% of new equipment market value.

Social Media Marketing Strategies for Beginners

Mar 14 2023

(0) Comments