No More Mistakes with Flour Mill Machine Manufacturer

Mar 11 2023

Understand accounts payable vs. receivable for startups. Learn how accounting and bookkeeping services help manage both with ease.

Knowing the distinction between accounts receivable and accounts payable is vital to managing the cash flow of your business.

Ceptrum We simplify managing finances by providing professional accounting and bookkeeping services for startups and help you keep at the top of your have to pay and the amount you owe. If you're employing Xero accounting software, QuickBooks for small business or you need assistance to get help with tax services for startups the following guide can break everything into pieces.

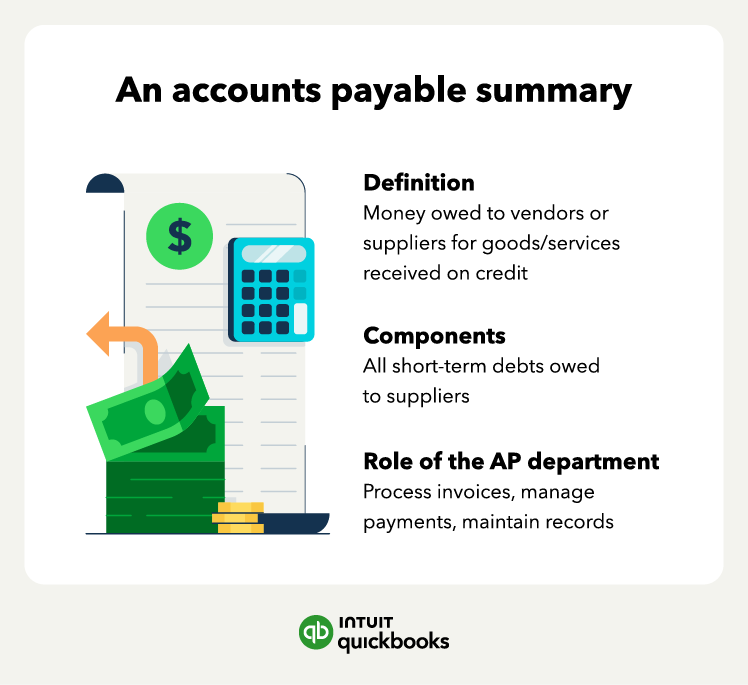

Accounts payable is the amount your business owes suppliers or suppliers.

Examples office rental, utility bills, purchasing inventory.

Category is recorded as a liability in your balance account.

The goal to pay promptly to keep good relations and be sure to avoid the cost of late payments.

The term "accounts receivable" refers to the amount customers owe to you for services or products.

Example invoices that are sent out to customers for work completed.

Category is recorded as a credit on the balance sheet.

Objective To collect payments on time so that cash flows are healthy.

Feature | Accounts Payable (AP) | Accounts Receivable (AR) |

Definition | The amount your company owes | The amount you owe to your company |

Balance Sheet Category | Liability | Asset |

Impact on Cash Flow | Outflow | Inflow |

Managed By | Vendor and supplier payment | Collections and billing for customers |

Cash Management of Flow Balance AP and AR will help to prevent cash shortages.

tax reporting Accurate data provide tax services for startups.

Confidence of Investors Clean books demonstrate the financial accountability.

Xero Accounting Software automates tracking invoices and payments reminders.

QuickBooks designed for Small Business - Offers integrated AP/AR dashboards.

Run monthly AP/AR aging reports in your QuickBooks for small business or Xero accounting software.

If either exceeds 30% of your monthly revenue, it's time to optimize," advises financial consultant Maya Rodriguez.

Startup Accounting Services We assist you in setting up and run AR/AP systems.

Personalized Bookkeeping Our Bookkeeping and accounting solutions for start-ups assure accuracy and adherence.

tax optimization Thanks to our tax-related services for entrepreneurs will have you prepared for any tax season.

Controlling the balance between accounts payable and accounts receivable is essential to ensuring financial stability. No matter if you're seeking small company bookkeeping, startup accounting services as well as expert assistance in using Xero accounting software Ceptrum can help each step of the way.

Explore Accounting solutions from Ceptrum And take charge of your company's cash flow now!

Social Media Marketing Strategies for Beginners

Mar 14 2023

(0) Comments